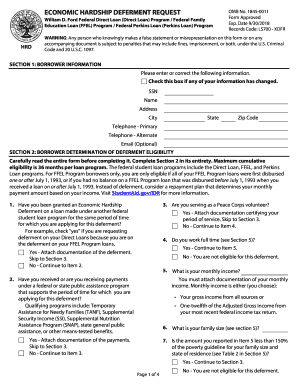

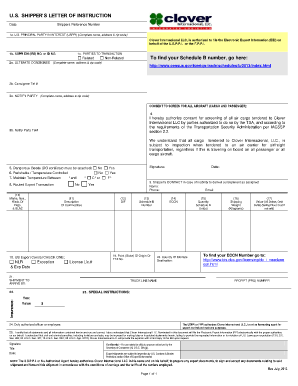

Direct Loans LS003-XDFR free printable template

Show details

LS003-XDFR U.S. Department of Education FedLoan Servicing P. O. Box 69184 Harrisburg PA 17106-9184 Fax 717-720-1628 If you need help completing this form call 800-699-2908 800-699-2908 If no phone number is shown call your load holder. If you are calling internationally call 717-720-1985 If you use a telecommunications device for the hearing or speech impaired TTY dial 711 and enter 800-699-2908 when prompted*calling internationally call 717-720-1985 If you are Web Site use a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign in school deferment waiver form

Edit your in school deferment form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student loan deferment form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deferment form online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loan deferment form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sallie mae in school deferment form

How to fill out Direct Loans LS003-XDFR

01

Obtain the Direct Loans LS003-XDFR form from the official website or designated office.

02

Read the instructions carefully to understand the requirements for completion.

03

Fill in the personal information section, including name, address, and contact details.

04

Provide the required financial information, including income and expenses.

05

Complete any sections related to loan amounts and purposes.

06

Review the form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form to the designated loan office or online portal.

Who needs Direct Loans LS003-XDFR?

01

Individuals seeking financial assistance for education-related expenses.

02

Students enrolled in eligible colleges or universities.

03

Parents or guardians applying for Parent PLUS loans for their dependent students.

04

Anyone looking to consolidate existing federal student loans.

Fill

fedloan servicing deferment

: Try Risk Free

People Also Ask about sallie mae deferment form

What qualifies for in school deferment?

In-School Deferment You are eligible for this deferment if you're enrolled at least half-time at an eligible college or career school. If you're a graduate or professional student who received a Direct PLUS Loan, you qualify for an additional six months of deferment after you cease to be enrolled at least half-time.

Is a deferment the same as a waiver?

If the court grants you a deferral, payment may be postponed to the end of the case or you may be required to pay a portion of the fee now and be given additional time to pay the balance. If you are awarded a waiver you will not be required to pay the fees.

Who qualifies for deferment?

You are eligible for this deferment if you're enrolled at least half-time at an eligible college or career school. If you're a graduate or professional student who received a Direct PLUS Loan, you qualify for an additional six months of deferment after you cease to be enrolled at least half-time.

What is a deferment waiver?

If the court grants you a deferral, payment may be postponed to the end of the case or you may be required to pay a portion of the fee now and be given additional time to pay the balance. If you are awarded a waiver you will not be required to pay the fees.

Does in school deferment count towards PSLF waiver?

Generally, time in deferment does not count as time in repayment but under the time-limited PSLF rule changes, deferment periods will count under limited circumstances: Time spent in specific military-related deferments will count as time in repayment.

Can you waive in school deferment?

Yes. You can decline an in-school deferment on your loans that are in repayment status and make qualifying payments on those loans while you are in school. Remember, in order for your payments to qualify for PSLF, you must be employed full-time by a qualifying employer while you attend school.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my xdfr in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your ls003 deferment printable as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit ls003 deferment request fillable straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing ls003 school deferment printable, you need to install and log in to the app.

Can I edit federal loan deferment form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign federal student loan deferment form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is Direct Loans LS003-XDFR?

Direct Loans LS003-XDFR is a form used by educational institutions and lenders to report information about Direct Loan disbursements for students enrolled in federal financial aid programs.

Who is required to file Direct Loans LS003-XDFR?

Educational institutions and lenders that participate in the Direct Loan Program are required to file the Direct Loans LS003-XDFR.

How to fill out Direct Loans LS003-XDFR?

To fill out Direct Loans LS003-XDFR, institutions must provide specific data including student information, loan amounts, and disbursement dates as outlined in the form's instructions.

What is the purpose of Direct Loans LS003-XDFR?

The purpose of Direct Loans LS003-XDFR is to ensure accurate reporting and tracking of federal Direct Loan distributions, ensuring compliance with federal regulations.

What information must be reported on Direct Loans LS003-XDFR?

The information that must be reported includes the student's identification, loan amount, disbursement dates, and any adjustments or cancellations related to the Direct Loan.

Fill out your Direct Loans LS003-XDFR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferment Request Form is not the form you're looking for?Search for another form here.

Keywords relevant to deferment form student loans

Related to in school deferment

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.